Hi {{first_name}} ,

It's Edwin here, with a fresh drop that's got me fired up. Dr. Michael Burry just lit the fuse again on $GME ( ▲ 0.13% ), and if you're in this community, you know exactly why this matters. The Big Short legend himself is hinting at the undisclosed swap cycles that crushed shorts before, and history looks ready to rhyme hard.

Let's break it down together, because these puzzle pieces are snapping into place right now.

Disclaimer: I am not a financial advisor and I do not give out financial advice. All forward-looking statements subject to risks and uncertainties. Past performance does not guarantee future results. This newsletter and TMC Robots are for entertainment purposes only.

Quick tip: this newsletter reads best on our website. Just sign-in with your email to access.

🎯 New to swap cycles? Check out this article before you continue.

Insights

The Big Short Speaks: Burry's Latest Bombshell

Dr. Burry dropped a new piece on his Substack titled "Foundations: The Big Short Squeeze." He highlights a clear pattern in $GME: a glitch in the system, a repeating algorithmic sequence tied to swap cycles. These aren't random. They show up like clockwork and put massive pressure on anyone betting against the stock.

Here’s an excerpt from his newsletter:

Support Dr. Burry and catch his newsletter here: https://michaeljburry.substack.com/p/foundations-the-big-short-squeeze

But here’s the thing, Dr. Burry is not explicitly calling out the $GME swap cycles. In fact, it would seem, he’s just getting started with discussions in this new $GME “Foundations” post by acknowledging the anomaly of sudden and unexplainable massive volume.

Swap cycles are kryptonite to shorting hedge funds and are periods, prone to sudden squeezes

The 2018 Receipt: Swap Cycle Heat in Full View

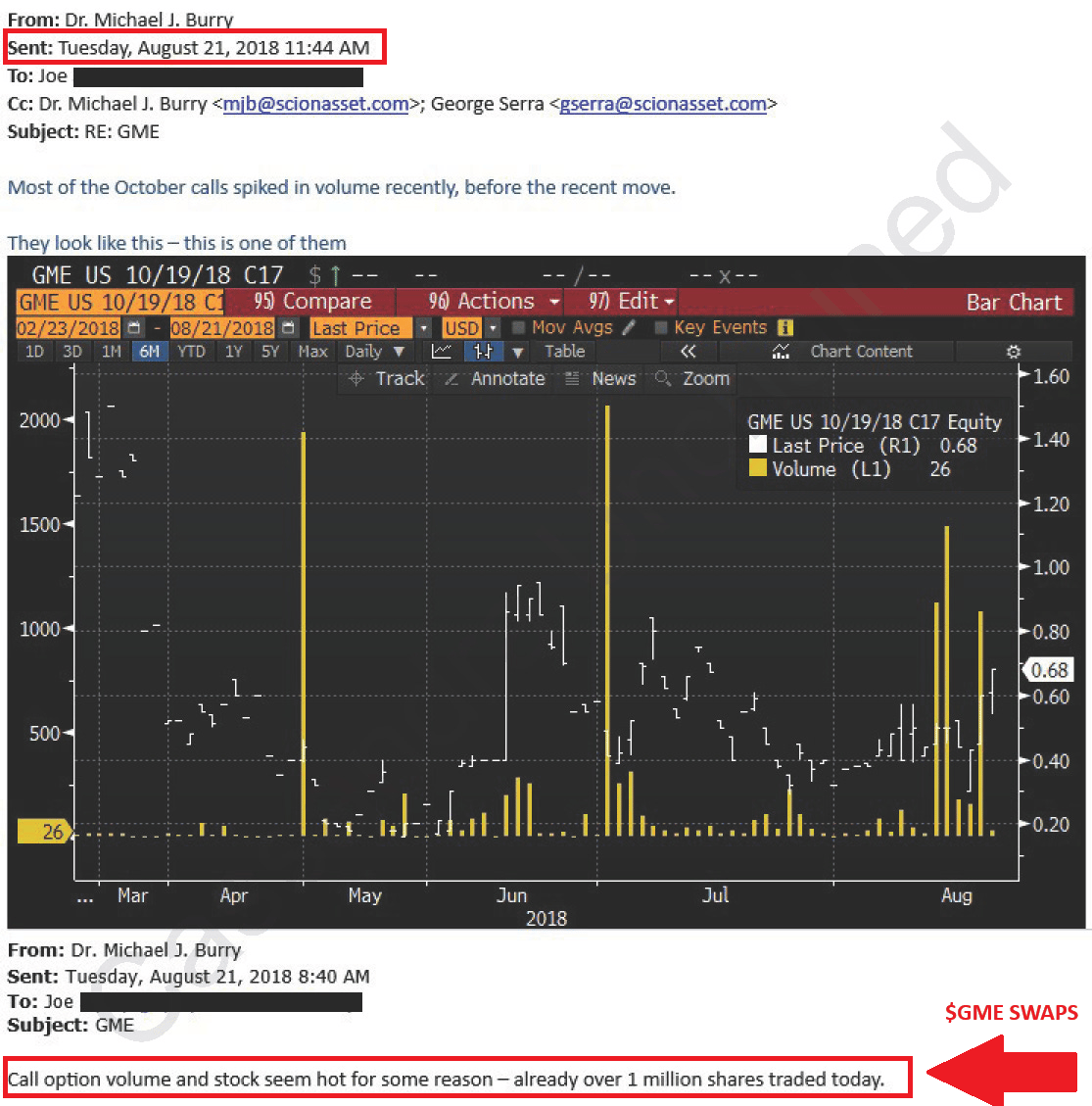

Back on August 21, 2018, during a peak swap cycle period, Burry emailed: "Call option volume and stock seem hot for some reason - already over 1 million shares traded today."

$GME swaps in AUGUST getting noticed by Dr. Burry

He saw something.

The Big Short Guy had a feeling this was unnatural and he called it out in an email to Joe, his analyst at the time on $GME stock.

From Dr. Burry’s Bloomberg terminal revealing swap cycles for $GME May/August 2018

Volume was exploding, call options were pouring in, and the stock was moving. Swap cycles create this exact environment, leaving shorts naked and vulnerable if buyers step up big.

Almost as if on cue, the Big Short Guy drops a bombshell revelation calling out very high volume to alleged naked short selling:

Dr. Michael Burry noticed: NAKED SHORT SELLING $GME

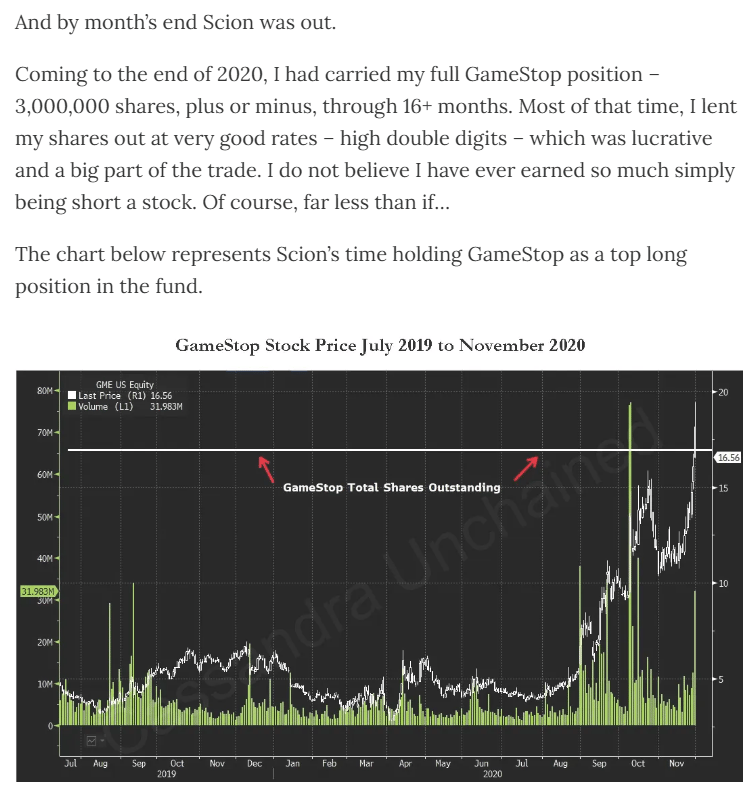

This becomes even more obvious when you factor in total outstanding shares for GameStop were only 101M authorized at that time, and was trading 30-60M in daily volume and reaching nearly 120M shares during these swap cycles. Crime in plain sight.

Throughout the newsletter, Dr. Burry, continuously drops clues about unusual activity about $GME and at one point he even alludes to Overstock. It’s a funny thing, that $OSTK and how it came to be $BYON but is now $BBBY. Is this starting to make sense? If not, hodl on.

The Big Short Guy was in on $GME, in before the recombination of $BBBY and has now returned to the scene of the squeeze. Only this time, he’s recounting the events and laying the foundation for what’s coming next. New, all time highs.

RoaringKitty Joins the Party

Burry wasn't spotting this alone. The infamous Cat in a White Hat (you know the one) noticed the same anomalies around that time. These signals screamed opportunity to the sharp eyes watching.

RoaringKitty, The Cat in a White Hat

Still, it wasn’t obvious enough to The Big Short Guy. In fact, he even dismissed RoaringKitty’s attempt at outreach and the two never spoke, according to Dr. Burry. Nevertheless, Dr. Burry admits he looked into RoaringKitty and discovered RK was sharing his thesis online in August 2019.

What’s interesting isn’t the encounter, but about how this particular month of August keeps popping up (or off) in all of his emails. From correspondence to recounts of the timeline by Dr. Burry. Almost as if, if he wants the reader to look a little closer for themselves. Must be a coincidence, like swaps.

Ryan Cohen's Early Move: Connecting the Dots in 2019

That attention caught Ryan Cohen's eye. Before he became Chairman, Cohen reached out to Burry in 2019. They saw the same potential in GameStop's setup, the structural edges that could turn the tables on Wall Street.

However, Dr. Burry sold.

That’s right, in November 2020. The man who held short in 2008, but flipped long, used the opportunity of Ryan Cohen entering the saga to exit GameStop stock.

Yes, it’s true, Dr. Burry admits he missed the rocket and the timing of Ryan Cohen gave him the opportunity to sell:

Dr. Burry held 3M shares exiting at $13.50 (from $3.32 avg cost at 306% return)

Dr. Burry provides context for the exit. Investors in his fund were exiting and they needed liquidity, so he was forced to make concessions. Burry bought at $3.32 average cost, and sold at $13.50 (306% return). All 3 million $GME shares produced a sizable return, but if he only knew what The Cat in the White Hat and the Chairman had in store for 2021.

The 2021 Gamma Squeeze: How Retail Flipped the Script

Burry exited his position in November 2020, right before the January 2021 explosion. Retail loaded up on call options. Market makers like Citadel and Virtu had to hedge by buying shares to stay delta neutral. Prices rocketed, options went deep in-the-money, FOMO kicked in, and the whole short thesis nearly imploded.

Quick recap on how it worked:

Step | Action | Result |

|---|---|---|

1 | Retail buys call options | Increases open interest |

2 | Market makers hedge | Buy actual $GME shares |

3 | Share price rises | Options move ITM |

4 | Gamma accelerates | Forced buying snowballs |

Naked Shorts Exposed: Volume Spikes Tell the Story

Burry calls out multiple periods of unusually high $GME volume across years. His take? Classic signs of naked short selling trying to suppress price, but failing when cycles align and buyers show up.

The Big Short Guy saw a pattern, but he couldn’t put his finger on it. With short interest at 100% for months on end and despite bullish catalysts, the stock refused to move. He couldn’t figure it out.

“Short interested remained at ALL-TIME HIGHS, and the stock did not react”

You see, that’s just the thing.

Naked short selling creates synthetic fake shares to cause downward price action and when combined with derivative swaps, it will move entire markets, but not the price. Dr. Burry had his finger on the pulse and could even see it on the Bloomberg terminal, but no, these invisible hands require looking at an entire basket of meme stocks.

Beyond the Forest of Meme Stocks

In a forest, you cannot see beyond the trees unless you climb up to the top.

Unfortunately for Dr. Burry, that top reached peak velocity on January 28, 2021 when the stock price rocketed to $483 during intraday trading hours. At 3 million shares, Dr. Burry would have made $1.45B instead of exiting at $40M.

The following reports from the SEC and house financial oversight committee all point to the same thing without labeling it: swaps. It is the invisible hand that controls the markets and GameStop is the leader of the pack, or should I say idiosyncratic risk of the basket.

Here are the receipts that reveal the forest for the trees, a basket of meme stocks:

$GME short interest 226% on February 3, 2021 (post-gamma squeeze)

The Requel Is Here: Trio Reunited for Round 2

Now in late 2025, the signals are flashing again. Burry highlighting the pattern. Echoes of the Cat. Ryan Cohen at the helm with a fortress balance sheet. Swap cycles recurring. This feels like GameStop: The Requel, with the same players positioned to stomp shorts once more.

I've been tracking these exact mechanics in TMC Research pieces like "Episode 21 Bombshells: $GME, Burry's Bet, and Secret to paying off $35 Trillion Debt," the Swap Cycle Run Timeline, and FTD Research available inside Discord only. The data lines up perfectly and I’ve got dates lined up to see it unfold.

We are less than 2 weeks away from the end of 2025, perhaps 1 week away from a Christmas marker, and ready to begin the march towards swap madness. I will be watching closely to see what Dr. Burry has in store with his GameStop mini-series, but it doesn’t change the thesis: shorts are f*cked. Tik Tok.

Stay tuned for the next article where I reveal 2 gems worth watching closely as it ties directly into the saga plus a hint from RC.

Very best,

Edwin