Hi {{ First Name }},

Welcome to an exclusive newsletter that unravels the mystery of Failure-to-Deliver (FTD) cycles and their significant role in trading GameStop ($GME). This edition draws from a recent private Discord livestream hosted by Scott, a seasoned trader who has spent years dissecting these cycles.

Disclaimer: We’re not financial advisors—this is for entertainment and research purposes only. Past performance doesn’t guarantee future results. Trade at your own risk.

You can now watch the video replay here for a deeper dive into this fascinating topic. Our focus today is the C+35 swap cycle—a 35 calendar day period tied to FTDs that has historically driven massive run-ups in $GME’s stock price.

Here are my research notes tracking the original swap cycles, including Criand’s thesis which maps Ryan Cohen’s initial purchase that kicked off the $GME FTD Swap Cycle:

Heads up: before you read any further, the research contained in this newsletter is heavily dependent on the content presented from the Livestream video and swap cycles DD. This newsletter is a technical review of market mechanics but inside Discord, we make it a whole lot easier to digest information in simple step actions by following color-coded charts, as easy as 1-2-3.

Insights

What Are FTD Cycles?

Failure-to-Deliver (FTD) occurs when shares sold are not delivered to the buyer by the settlement date, often due to naked shorting or other market manipulations. For a heavily shorted stock like GameStop, these FTDs create pressure points that can lead to explosive price movements. As Scott explained during the livestream, these cycles are not random—they follow a predictable rhythm, influenced by LARGE VOLUME spikes (e.g., ATM offerings) and market maker tactics.

The C+35 cycle, a 35 calendar day window, is central to this phenomenon.

This all began when Ryan Cohen purchased his shares in August 2020, which caused a large volume spike and was immediately FTD by market makers. That event set things into motion when $GME first appeared on the Reg SHO threshold list in December 2020.

When they failed to deliver Cohen’s purchase, forced buy-ins occurred, pushing the stock price upward as shorts scrambled to cover. The market participants had to close out FTDs within this timeframe, which launched $GME to an all-time high on January 28, 2021.

Since that event, $GME has been stuck in an endless loop of FTD cycles. This is where we are today, and the thesis for diamond-handing may have changed, as signaled by Roaring Kitty, also known as DeepFuckingValue or Keith Gill in real life.

The C+35 Cycle: A Closer Look

Scott’s research, building on Criand’s foundational work, highlights how the C+35 cycle operates within a broader pattern. Here’s the breakdown from the livestream:

Cycle Trigger: A large purchase or event (e.g., Ryan Cohen’s August 2020 buy-in) generates significant buying volume. Market makers divert this to dark pools or ETFs, delaying delivery and creating FTDs.

Suppression Phase: For the first half (roughly 17-18 days), the price is driven down with shorting and negative media, keeping retail investors off-balance.

Run-Up Phase: As the 35-day deadline nears, buy-ins or gamma ramps (from options activity) force the price up, often peaking around a high-volume day.

Scott noted this pattern forms a U-shape on the chart—high at earnings, a dip, then a climb back up. He ties this to a 1-4-7 algorithm (1 day of volume, 4 days sideways, 7 days down, reversing to 7 days up, 4 days sideways, 1 day peak), repeating over 35 days. Historically, this has aligned with $GME’s January 2021 squeeze, starting November 4, 2020, and peaking January 28, 2021, after a 38% spike on January 12.

Historical Evidence

The livestream provides concrete examples:

August 2020 - January 2021: Cohen’s purchase led to FTDs, landing $GME on Reg SHO by December 2020. The C+35 deadline fueled the run from $20 to $483.

November 2021: Scott traded this cycle, turning $12,000 into $100,000 in calls before a rapid drop, illustrating the cycle’s volatility.

May 2024 vs. May 2025: A recent run-up followed a similar pattern, shifting two weeks from May 13, 2024 the prior year to May 27, 2025, showing the cycle’s annual slide.

Criand’s Swap Cycle Run data, referenced in my research notes, confirms these quarterly spikes—every three months: FTD resolutions drive squeezes, though market makers now compress these into single-day events using ETFs to delay obligations up to 70 days.

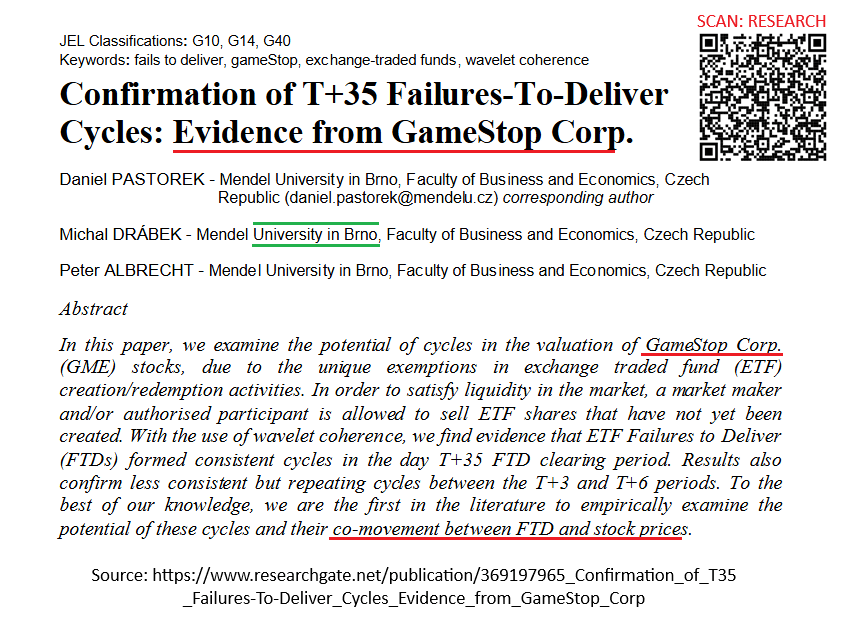

Furthermore, the research is backed by empirical evidence from researchers at BRNO University (RK signaled to Bruno, the movie) which modeled the FTD cycles and co-movements between [meme] stocks.

However, just modeling the movements for FTD is not enough. Due to market makers and stock manipulation which alters timing of $GME quarterly swap cycles and concurrent cycles (run-ups from other tickers), things often changes.

The good news: there is even more opportunities now due to the meme stock basket carrying multiple tickers, not just $GME anymore and are firing off concurrent cycles as Scott has revealed in the livestream. For this reason, we are now proactively tracking multiple tickers ($CHWY, $DJT, etc.) to take advantage of ALL these opportunities inside Discord-only.

Trading Strategies

Scott shared actionable insights for leveraging these cycles:

Entry Timing: Buy slightly out-of-the-money calls several days before the anticipated peak (e.g., three weeks before earnings or mid-cycle). Scott’s success with options trading with calls highlights this approach, and it works with shares too.

Exit Strategy: Sell at the peak—often a single day—before shorts dump shares. He warns against holding too long, as seen in his November 2021 loss.

Risk Management: Use only a small percentage (1-5%) of your capital on options to mitigate volatility risks, and turn pennies into hundreds of dollars.

He views $GME as a “Bank ATM,” offering multiple cash-out opportunities yearly if traders sync with the cycle, not just diamond-handing for a one-time squeeze. This actually aligns with the research I’ve been sharing about for a timeline that extends into 2026 and 2027, in what has been dubbed XYZ and requires X, the Everything App, to be in place as a Bank (currently FDIC registered with X Money licenses across all U.S. states, read here).

RoaringKitty acknowledge his thesis changed here and signaled to $GME as his bank ATM here. Utilizing this newfound knowledge to trade quarterly swap cycles and concurrent cycles does not change the previous thesis.

Diamond handing, not selling and accumulating is a proven strategy with DRS that will be beneficial with release of Project Open: XYZ peer-to-peer trading in late 2026/2027 (per SEC confirmation, see PDF here).

The image above is no longer a meme.

$BBBY court cases extend to December 2025 (see court docket receipts here) which will likely tie into RICO for securities fraud before they issue any new equity.

The opportunity is here: learn the swap cycles, learn how to trade with cycles, and it will turn $GME into your personal bank ATM machine. This is what RoaringKitty is doing and inside Discord, we intend to do the same.

Join Our FTD Think Tank

I’m thrilled to announce a game-changing initiative within our private TMC Discord (active membership required). I’ve created a new @researcher role and a dedicated #ftd-tracking channel to form a think tank focused on cracking the FTD swap cycle code (with multiple tickers simultaneously tracked for “concurrent cycles”).

If you or someone you know is actively tracking C+35 cycles, is a seasoned Technical or Options Trader, or has experience building data models with machine learning or AI, let me know! We’re extending invitations to join this exclusive research group, but it requires active participation—not just observing.

🎯 What’s in it for you? Algo-hacking FTD cycles!

This groundbreaking research could turn swap cycles into a literal “Bank ATM,” letting us print cash by buying dips with shares, snagging options (pennies per contract) before rips, and selling at peaks. I’m all in on Scott’s research, and Roaring Kitty’s signals suggest a shift from diamond-handing to trading these cycles, with DRS better suited for those holding for XYZ peer-to-peer trading in late 2026/2027 (per SEC confirmation).

You don’t need to join the think tank to benefit—all TMC Discord members will get the full scoop on how to trade these cycles. The @researcher role is for those ready to dive in and build foundational datasets now for predictive trading (and possibly Ai-trading), ahead of the next cycle in August 2025. Think of it like a science project: hypothesize, test, experiment, win. The best experiment means we all win big.

Important: Keep this off X. We’re not advertising a service—past attempts got shut down fast. Notes, spreadsheets, and details are Discord-only.

Current team: We now have multiple researchers with backgrounds in data modeling, data extraction, machine learning, and Ai-modeling. Looking for experienced options traders that love data, tracking greeks for hedging flows, liquidity pools, more.

Think Tank Details | Description |

|---|---|

Role | @researcher (active participation required) |

Channel | #ftd-tracking (private, Discord members only) |

Goal | Build datasets and models to predict and trade C+35 FTD cycles |

Who Can Join | Experienced traders or data scientists (Technical/Options Trading, ML/AI) |

Benefits | Access to cutting-edge research, trade like Roaring Kitty, potential for massive gains |

Next Steps | DM me to nominate yourself or others for an invitation (pending proof of work and verification) |

Sign-up for TMC Discord

Not interested in becoming a researcher but want the inside scoop on the cutting edge of trading $GME quarterly swap cycles and concurrent cycles ($DJT, $CHWY)? No problem!

Sign-up today and activate your Discord membership here.

Future Outlook

Scott predicts the next cycle will ramp up between July and August 2025, with a potential spike in February 2026 if catalysts like a share recall emerge. Scott’s thesis suggests:

July-August 2025: A build-up phase, with tweets from trusted signal accounts for entry points and mapped against technical analysis on charts.

Multiple run-ups: Between now, July, and August, we anticipate multiple stock tickers in the basket exploding which will be tracked. This will create opportunities to roll profits from one trading cycle into another (“concurrent cycles”), before the major quarterly Swap cycle run-up in August 2025.

February 2026: A possible major run, though shorts will fight to suppress it.

The floor is rising—$GME holds above $20 consistently—indicating growing strength. Scott believes trading these cycles can fund positions in other “Infinity Stones” (e.g., Chewy, DJT) for the ultimate squeeze. With our think tank, we’re gearing up to fine-tune models for multiple tickers, creating back-to-back trading opportunities—an infinite money glitch if we buy, sell, rinse, and repeat.

Preparing for Beyond

Decoding FTD cycles transforms $GME from a hold-and-hope play into a strategic trading opportunity. Scott’s meticulous analysis, paired with Criand’s swap cycle framework, and my research into connections reveals a repeatable pattern TMC members can exploit. Our new think tank takes it to the next level, aiming to make us all millionaires (or billionaires!) like Roaring Kitty’s May 2024 run.

Watch the replay, check the research data/charts, and jump into #ftd-tracking channel on Discord to stay in the loop. Let’s keep this rocket soaring—see you in the members’ chat!

Very best,

Edwin