Hi {{ First Name }},

Welcome to the latest drop of TMC Research!

We’ve got GameStop’s Bitcoin saga heating up, BEYOND ($BYON) primed for a rocket ride, and a Bed Bath & Beyond’s M&A drama dropping bombs with every docket release.

Disclaimer: I am not a financial advisor and I do not give out financial advice.

Buckle up—this isn’t just market chatter; it’s a front-row seat to a revolution. From crypto moonshots to RICO-fueled takedowns, we’re diving deep into the signals, the charts, and the moves that could flip Wallstreet on its head.

Let’s roll!

Insights

GameStop’s Bitcoin Blitz

Ryan Cohen’s Margin Play and Michael Saylor’s Strategy

Ryan Cohen, the meme lord of $GME, is stacking the deck. He’s moved 60% of his 37 million shares—22 million, worth half a billion bucks—into a Charles Schwab margin account. Risky? Hell yes. Leverage like that screams big bets, and the tea leaves point to Bitcoin.

Rewind to January 27, 2025: Cohen shifted 36.8 million shares from RC Ventures to his personal stash (SEC 13D filing), grabbing 8.2% of GameStop. By April 4, he snagged another 500k shares for $10.78 million, hitting 8.4%. Now, with 22 million on margin, he’s got skin in the game—and a hand on the wheel.

Cue Michael Saylor, Bitcoin’s loudest evangelist. February saw Cohen and Saylor posing for pics, and by March 25, Saylor’s X post synced with GameStop’s bombshell: they’re ready to convert up to $4.8 billion cash into $BTC as a treasury asset. No ceiling, just pure crypto YOLO.

April 4’s $1.5 billion capital raise? That’s fuel for the Bitcoin fire (see previous newsletter). Cohen’s April 3 X post—“These tariffs are turning me in to a dem” with a rainbow emoji—nods to the Bitcoin Rainbow Chart. Blue bands mean “buy the dip,” and at ~$77k (April 7).

Here’s where it gets spicy. Strive Asset Management, co-founded by Vivek Ramaswamy (yeah, President Trump’s ex-rival turned ally), sent Cohen a shareholder letter pushing for Bitcoin.

Cohen’s X reply? “Letter received.”

Subtle, but a megaphone to the apes. And here’s the kicker Vivek was the guest speaker at Pulte’s event on May 7, 2024 (video).

RC confirms letter received from Vivek’s investment firm Strive; Vivek was at Pulte event

Meanwhile, Saylor’s playbook—Strife and Strike are debt-equity swaps—mirrors MicroStrategy’s $MSTR moves (see their January 27, 2025, SEC prospectus). GameStop’s December 8, 2020, filing echoes the same vibe. Coincidence? Nah, it’s a signal flare.

Jesse Myers, a Stanford MBA and financial researcher retweeted by Saylor, does an excellent job breaking down how $MSTR will acquire $BTC. This involves using Strike $STRK and Strife $STRF as financial vehicles to tap into capital (see post here), and $GME is following the same playbook from Saylor with the $1.5B convertible note.

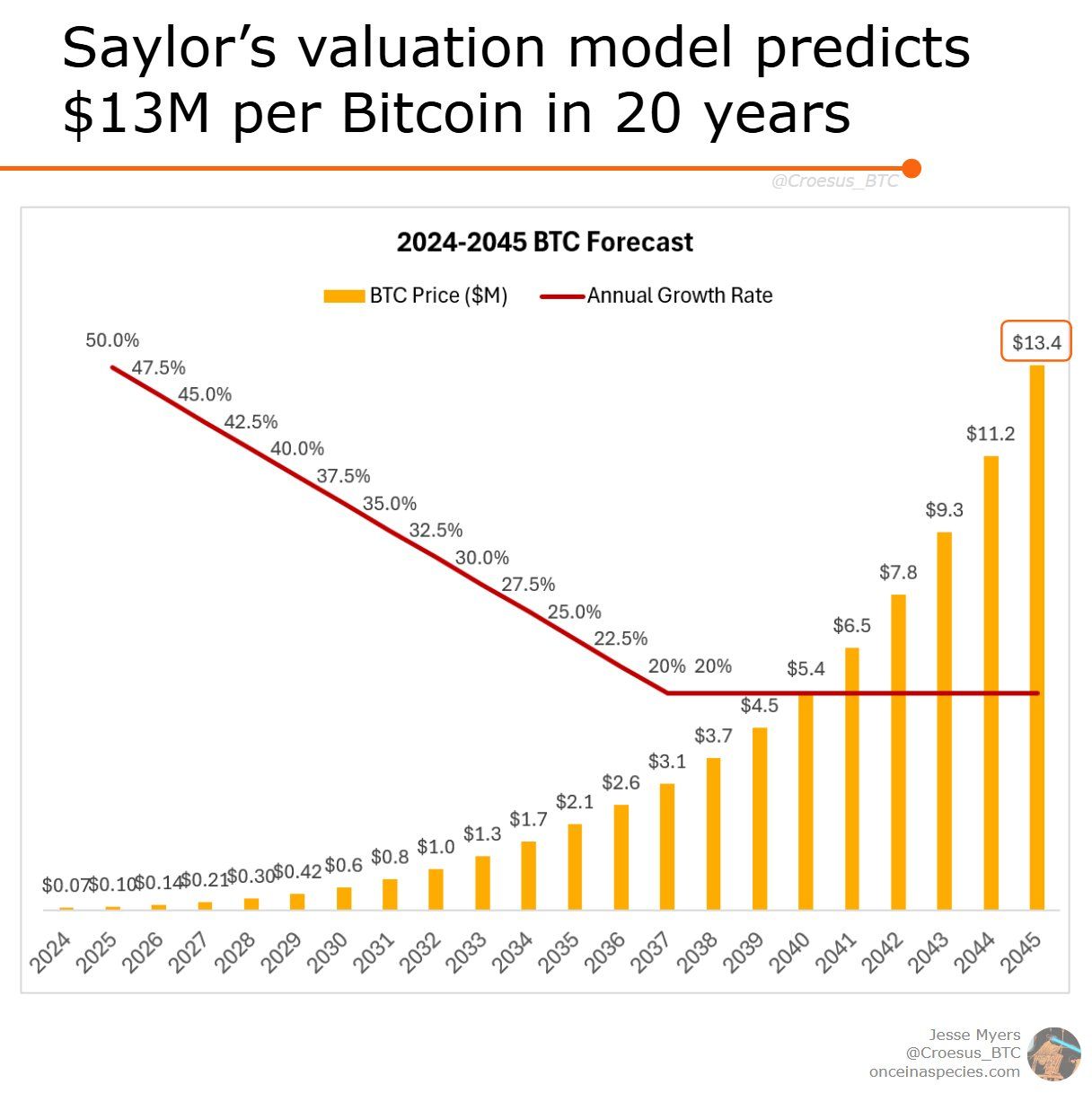

Saylor’s Bitcoin price model prediction with current growth trajectory reveals $BTC will reach $13M per coin and this can be achieved by utilizing $STRF to tap into the $300 Trillion bonds market for capital. Every bonds trader in the world will want to work with $MSTR for higher returns than a bond rate yield. As $BTC appreciates in value, bond holders that trade for $STRF, will also be able to earn a dividend (full thread on mechanics here).

Full thread here: https://x.com/Croesus_BTC/status/1899841024131825776

It is inevitable. Corporate balance sheets will include $BTC as treasury and deploy Saylor’s Strategy to convert cash for Bitcoin. The current rate of return for $MSTR holding Bitcoin is significant compared to the magnificent 7. This is why GameStop Corporation has adopted $BTC, it’s simple math based on returns and makes sense with cash as a liability due to inflation.

Bottomline: the reason for acquiring Bitcoin and holding it as a treasury is for dividends.

Crypto on the Brink of Altcoin Season

The May $GME Swap cycle’s looming, and if GameStop confirms a BTC buy, it’s game over for the bears. I predict a “super bull run”—highly shorted stocks, Bitcoin, and Altcoins such as Litecoin, Ethereum, and even meme coins like $GIL (linked to Roaring Kitty).

Altcoins are expecting a massive bull run which is usually linked to a decline in Bitcoin dominance (reaching above 60%) and has appeared in 2 previous cycles (thump, thump, thump).

Bitcoin dominance refers to the measure of Bitcoin’s value in comparison to the total market capitalization of all other cryptocurrencies combined. It’s a commonly used metric in the cryptocurrency market to gauge Bitcoin’s market share relative to the entire crypto market. Read more about Altcoins and Bitcoin dominance here.

$BTC crashed in 2021, then Altcoins exploded

Altcoins can be tracked by following the leader Ethereum $ETH which has been hitting all-time lows for several weeks now, as seen in this picture below. The top chart reveals Bitcoin dominance hitting highs not seen since 2021 (before a crash) and Ethereum hitting lows not seen since 2021 (an inverse relationship) due to capital flows when institutions fear of $BTC price crashing, so they move money to altcoins.

$BTC and $ETH as leading altcoin, an inverse relationship

Litecoin Signals to $GIL

Besides, there’s also this:

Litecoin’s X shoutout to $GME and Kith Gill’s posts? The ecosystem’s primed to explode. Hedge funds are sweating—FUD’s flying, but the apes are hodling.

Previously, Litecoin made a return on X in a big way by referring to $GME ( ▼ 1.97% ) and I made a full thread showing the connections that lead directly into X (see post here).

TLDR: X Money is preparing for a launch and it may use the lightning network, which is layer 2 scaling and native to Litecoin (also an altcoin).

Altcoin Bull Runners

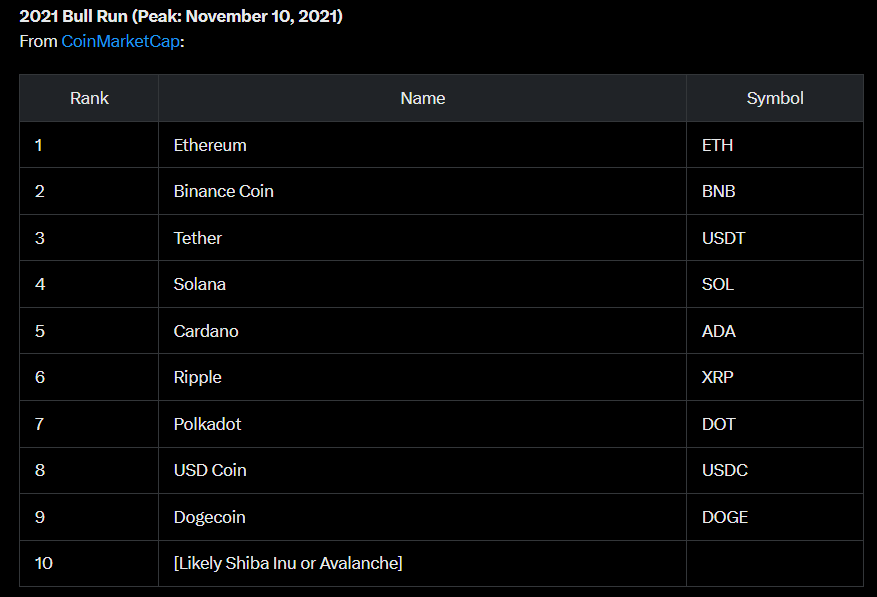

The Altcoin bull run of 2021 revealed the Top 10 coins, according to Grok:

From the list of Altcoins: Solana $SOL, Cardano $ADA, Ripple $XRP, and several others have been confirmed as the Digital Asset stockpile by President Trump via Executive Orders and crypto portfolio WLFI reveals $ETH is 94% of holdings (see wallet here).

Previously, I wrote about Crypto coins for the Golden Age, see this post.

BEYOND ($BYON): Token Time and Chart Fireworks

Digital Token Drops: BUYBUYBABY and O Token

BEYOND ($BYON) is lighting up.

Chairman Marcus Lemonis confirmed April 24, 2025 drops the mysterious “O Token.” Then, May 8, 2025, as the launch date for the buybuyBABY tokenized IP (intellectual property) digital token—shareholders as of April 1 get preferred pricing.

Details are thin, but the vibe’s electric. This ain’t just hype; it’s a play to tokenize value and juice the stock.

Technicals: Screaming Liftoff

Check the charts (posted in TMC Discord):

$BYON’s hovering above a key support line, mirroring a mega bullish signal from October 30, 2023. Back then, it dipped to $12, peaked at $36, then crashed.

Now? Same purple-chart energy on the daily timeframe. With tokens incoming, this could be a slingshot to the moon.

$BYON chart - Daily timeframe

Bed Bath & Beyond: Canada Annex and RICO Rising

Mark Carney and the Canadian Connection

Bed Bath & Beyond’s saga is a rollercoaster. Court cases stretch into May, but the real juice is the “Canada Annex.” Enter Mark Carney—ex-Brookfield Property Management chair, now Canada’s PM (the connections lead to Middle Eastern Sovereign Wealth Funds, confirmed by Senate here).

I call Mark Carney the signal. Why? A merger play tied to Bed Bath & Beyond Canada’s parent entities, utilizing tax write-offs (NOL) and spinning off a new corp. The White House’s “acquiring Canada” narrative (since January 2025) ties into MAGA’s “White Hats” ousting the deep state. Wild? Yup. Credible? IRS disclosures back it with 38 DK-Butterfly shell entities.

I made a video for you here.

TLDR: $bbby cash payout and new equities are coming

RICO Case: The Big Reveal

Then there’s the RICO bomb. This ain’t just about $BBBY—it’s a Wallstreet takedown. Bed, Bath & Beyond’s securities forensic expert Elise Frejka is linked to Meta Materials ongoing litigation through Kasowitz, Benson, Torres law firm (see post here).

Meanwhile, court dockets link to Meta Materials ($MMTLP) and $GTII, exposing short sellers like Anson Funds, Virtu Finance, and Citadel Securities (see subpoenas served to short sellers).

George Palikaras (ex-Meta Materials CEO) and Trump insiders include John Forster including Pam Bondi’s brother are in the mix.

John Forster disclosure $DWAC pre- $DJT, now involved in $GTII

Next, Forster confirmed Paul Hastings LLP will be involved with $GTII ( ▼ 40.0% ) which leads to Brad Bondi, the brother of Attorney General Pam Bondi. These powerful connections are starting to reveal just how big this RICO case has become.

This is exactly what every shareholder of a highly shorted stock wants to see: prosecution of financial criminals for market manipulation, securities fraud, and conspiracy. The basis for a RICO case.

Pulte had a “great chat” with $DJT CEO Devin Nunes

Kash Patel, FBI head, says RICO’s the hammer—tracing wire fraud, nailing manipulators from top to bottom. Nancy Pelosi’s insider trading? On the chopping block. This could spark a short squeeze tsunami.

Checkout this video clip where Kash confirms RICO is coming for the Deep State Cabal members and its criminal enterprise:

Timeline of Events

Event | Details |

|---|---|

Ryan Cohen Share Transfer | 36.8M shares to personal name, 8.2%, Jan 27, 2025 (SEC 13D) |

Additional Share Purchase | 500k shares, $10.78M, Apr 4, 2025; 22M into Schwab margin, 8.4% total |

GameStop: Bitcoin as Treasury | Announced Mar 25, 2025; $4.8B cash, no ceiling |

Cohen X Post | Apr 3, 2025: Rainbow emoji, Bitcoin chart hint |

BYON Token Dates | O Token: Apr 24, 2025 |

BBBY Court Cases | Pushed to May 2025; Canada Annex and RICO in play |

Litecoin X Signal | Apr 21, 2025: Ties $GME to $GIL |

The Bigger Picture

This isn’t noise—it’s a symphony. GameStop’s Bitcoin plunge, BEYOND’s token gambit, and Bed, Bath & Beyond’s RICO reckoning are threads in a tapestry of disruption. Texas exchanges (NYSE Texas, TXSE) signal a pro-business shift, while crypto’s poised to rip. The May $GME Swap cycle could ignite a Golden Age—decentralized finance, meme stock vengeance, and a Wallstreet purge. You’re not just watching history; you’re in it.

The financial frontier’s ablaze, and we’re riding shotgun. GameStop’s crypto leap, BEYOND’s token tease, and a RICO-fueled reckoning aren’t just headlines—they’re battle cries. Whether you’re stacking $GME, hodling $BTC, or holding bags of Altcoins, one thing’s clear: the revolution’s live, and it’s loud.

Stay sharp—the next few weeks could redefine the game.

Very best,

Edwin