Hi {{ First Name }},

Picture this: Ryan Cohen takes control of the $GME Idiosyncratic Ship, a new stock exchange launches in the heart of Texas, a fintech powerhouse emerges with Trump’s name on it, and the Lone Star State becomes ground zero for a market revolution.

We’re not just talking incremental change—this is a seismic shift, and it’s happening now. From crypto-fueled funds to a pro-business battleground, the stakes are high, and the opportunities are massive.

Let’s dive in.

Disclaimer: I am not a financial advisor and I do not give out financial advice.

Insights

Crypto Launchpad: Ryan Cohen and The Alamo

Buckle up, diamond hands and degens—it’s Tuesday, April 8, 2025, and the financial plot’s thickening faster than a hodler’s bags. We’re peeling back the layers on Ryan Cohen, GameStop, Trump Media (TMTG), and some shiny new Texas exchanges that smell like freedom and brisket. This isn’t your grandpa’s market report—it’s about share shuffles, crypto bets, and a pro-business playground that’s got investors and market junkies salivating. Let’s break it down.

GMERICA NFT: The Alamo (Texas, Financial Revolution)

Ryan Cohen, GameStop’s Executive Chairman and CEO, just pulled a slick move. He’s yanked 37 million shares out of RC Ventures—his VC sandbox—and slapped them under his own name. The paper trail’s legit: 13D filing dropped the bomb, Form 4 and 10K backed it up. Why? So he can play ball directly with GameStop’s cash pile, not just ride shotgun through his firm. This guy’s not messing around—he’s syncing his wallet with the company’s next big swing. More control, more skin in the game—classic power move.

Rewind to January 27, 2025: Cohen kicked this off by transferring 36,847,842 shares from RC Ventures LLC to his personal stash, per a January 29 SEC 13D filing. That’s 8.2% of GameStop’s total shares outstanding, for a total value of $96 million. RC Ventures is out as a reporting entity, and Ryan Cohen, as individual is now the one filing the 13D homework. Fast-forward to April 4, 2025—he snags another 500k shares for $10.78 mil, bumping his stake to 8.4%. Oh, and 22 million of those shares? Parked in a Charles Schwab margin account, per the 13D fine print under item 6.

Risky? Maybe. Ballsy? Definitely.

13D Filing reveals Cohen’s 22M $GME shares deposited into Charles Schwab

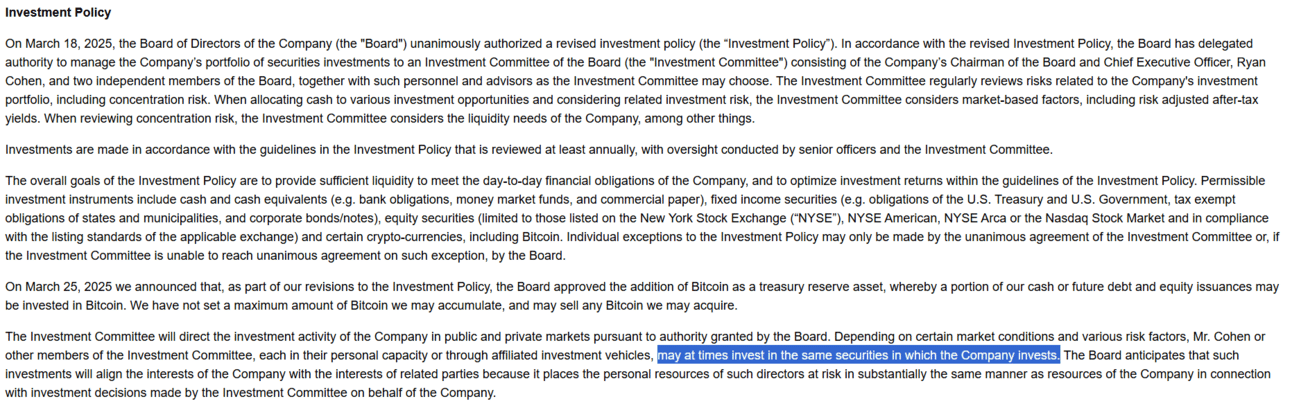

This all syncs with GameStop’s latest flex: Bitcoin’s now a treasury asset. Cohen’s buys—especially that April 3 grab of 500k more shares (shoutout 13D)—scream confidence. With 37,347,842 shares in his grip and the 10K greenlighting co-investment with GameStop Corp, he’s not just along for the ride—he’s got a hand on the wheel.

From $GME 10K, “Mr. Cohen… may at times invest in the same securities in which the Company invests.” Double dip confirmed.

GameStop YOLO: Cash Is Trash, $BTC Is King

GameStop dropped a bombshell on March 25, 2025, saying they’re dumping corporate cash into Bitcoin like it’s a Black Friday doorbuster—no cap on purchases, just a fat $4.8 billion cash pile (as of Feb 1, 2025) begging to be yolo'd into the crypto asset. The board gave it a big unanimous thumbs-up, betting on Bitcoin’s wild rollercoaster vibes to juice up their treasury. Think MicroStrategy, but with more meme stonk energy. Ryan Cohen’s been preaching cost-slashing and profit-chasing since he took the wheel, and now he’s got GameStop playing the $BTC card hard.

Fast forward to April 4, 2025—GameStop seals a $1.5 billion capital raise, and guess what? It’s Bitcoin shopping spree time (Sultan is backing $GME). They’re not just dipping toes; they’re cannonballing into the crypto pool, turning stacks of cash into a hodl-worthy asset that might actually moon soon. Cohen’s fingerprints are all over this, and the corporation’s moves scream “we’re buying the dip.”

Then there’s Cohen’s cryptic X post on April 3, 2025: “These tariffs are turning me in to a dem” (rainbow emoji included, naturally). Sounds like a sh*tpost, but dig deeper—it’s a nod to the Bitcoin rainbow chart, that trippy logarithmic thing from Blockchaincenter. Blue means “cheap af,” red means “fomo central.”

Meanwhile, inside TMC Discord we've posted charts—Bitcoin’s kissing the -2 standard deviation channel, flirting with lower Bollinger Bands, and tapping the 50-day moving average on the Weekly charts.

Translation? Technical charts are screaming “load the bags.”

If this meme-fueled saga’s taught us anything, $BTC might tap $69,000 soon—nice—and that could be GameStop’s green light to buy. The stars are aligning: Cohen’s been spotted cozying up to Michael Saylor (Bitcoin’s loudest cheerleader) on X back on February 10, 2025. Between the charts, the cash, and the vibes, GameStop’s all-in on Bitcoin—and I’m here for it.

$BTC Technical Analysis and Market Sentiment

To illustrate the technical analysis mentioned, particularly for Bitcoin, the following table summarizes key indicators from technical charts and research:

Indicator | Description | Implication |

|---|---|---|

Bitcoin Rainbow Chart | Logarithmic regression, colors indicate valuation | Blue bands suggest undervalued, buy opportunity |

Bollinger Bands (Lower) | Weekly chart analysis | Indicates volatility, potential breakout |

50-day Moving Average | Trend indicator | Supports bullish trend at current levels |

Standard Deviation Channels | Retracement levels for price support/resistance | Sept 2024 was the last dip before ATH rip |

This table highlights the technical factors supporting GameStop's Bitcoin strategy, reinforcing the trajectory of a strategic acquisition window.

Bitcoin rainbow chart: blue means buy opportunity

Additional Charts to Support GameStop’s Timing of $BTC Acquisition

$BTC Weekly chart - 50 Day Moving Average (purple)

$BTC Weekly chart - Bolling Band Lower (yellow)

$BTC Daily chart - down 2 standard deviation channels (Sept 2024 before ATH)

TMTG’s Bold Moves: Truth.Fi and NYSE Texas Take Center Stage

On March 31, 2025, NYSE Texas, part of Intercontinental Exchange, Inc. (parent company of tZERO), launched with Trump Media & Technology Group (TMTG) as its first listing—while still holding its primary spot on Nasdaq (Reuters - Trump Media Lists on NYSE Texas). TMTG, operating Truth Social and Truth+, is expanding into financial services via Truth.Fi, announced on January 29, 2025, with a $250 million investment (GlobeNewswire - Trump Media Launches Truth.Fi).

Partnering with Charles Schwab for custody and Yorkville Advisors as the Registered Investment Adviser, Truth.Fi is rolling out exchange-traded funds (ETFs) and separately managed accounts (SMAs) tied to American growth, manufacturing, energy, and crypto—think “Made in America” and “Bitcoin Plus.”

TMTG launches crypto venture Truth.Fi via Charles Schwab

Digging deeper, TMTG’s Truth.Fi launch in January 2025 (Bloomberg) is a calculated play to flex their $700 million cash reserves, with a $250 million investment through Charles Schwab, they’re targeting ETFs, SMAs, Bitcoin, and other cryptocurrencies. Truth.Fi is setting up six products—three ETFs and three SMAs—serving as a vehicle for acquisitions, with transactions potentially carried out via NYSE Texas.

NYSE Texas, now live in Dallas as of March 31, 2025 (BusinessWire), fits Texas’ pro-business vibe like a glove, attracting companies like TMTG. The connection to Charles Schwab and the investment strategy underscores Truth.Fi's role in supporting American companies and crypto ventures, as noted in a Reuters article from January 29, 2025, detailing TMTG's fintech expansion.

Truth.Fi's products, expected to launch in 2025 pending approvals, aim to address "debanking problems" and offer alternatives to "woke funds," aligning with America First principles. Transactions may be facilitated through NYSE Texas, given TMTG's listing, though the user's "vehicle for acquisition" likely refers to investment focus rather than corporate acquisitions.

Texas Exchanges and Market Implications

Texas is flexing its financial muscle. NYSE Texas, a fully electronic equities exchange, went from announcement in February 2025 to live trading in March (Axios).

Meanwhile, the Texas Stock Exchange (TXSE), backed by heavyweights BlackRock and Citadel Securities, has raised $161 million and is gunning to rival NYSE and Nasdaq. Plans are in motion for a 2025 launch and listings by 2026 (Reuters, June 5, 2024).

This competition, alongside Nasdaq's regional office plans, positions Texas as a free market hub, possibly echoing Marcus Lemonis' references to a now-deleted X post captioned, "Welcome to the Free Market."

Marcus Lemonis now-deleted post, “Welcome to the Free Market” (signal to NYSE)

This setup could kneecap short sellers. Texas’ regulatory lean might dial back suppression tactics, paving the way for long-term growth. With TMTG on NYSE Texas and TXSE backed by financial titans, we’re seeing a pivot to issuer-friendly markets—a theme that keeps popping up in talks about investor upside.

Texas already boasts the most NYSE-listed companies, with over $3.7 trillion in market value, is cementing its role, with TXSE's apolitical stance according to ABC News, “What to know about the new Texas Stock Exchange” posted on June 5, 2024.

Timeline of Events

A recap of major news, Ryan Cohen posts, and signals pointing to a major event on the horizon.

Event | Details |

|---|---|

Ryan Cohen Share Transfer (13D) | 36.8M shares to personal name, 8.2% ownership, Jan 27, 2025 |

Additional Share Purchase | 500,000 shares, $10.78M, Apr 4, 2025, total 8.4% ownership with 22M shares deposited into Charles Schwab |

GameStop: Bitcoin as Treasury | Announced Mar 25, 2025, no purchase ceiling, $4.8B cash holdings |

Ryan Cohen X Post | Rainbow flag, Apr 3, 2025, interpreted as Bitcoin rainbow chart reference |

Bitcoin Price (Apr 7, 2025) | ~$77,000, near support levels, potential dip to $69,000 (meme signal) |

NYSE Texas Launch | Mar 31, 2025, TMTG first listing ($DJT), dual with Nasdaq; NYSE moves ahead of TXSE launch |

Truth.Fi Investment Vehicle of TMTG | $250M investment, TMTG partnered with Charles Schwab, Yorkville Advisors, focus on American and crypto assets: Bitcoin, stablecoins, etc. |

TXSE, Competitor Planned Launch | 2026, backed by BlackRock, Citadel, $161M raised, electronic exchange |

Grok image: President Trump is backing GameStop via Charles Schwab and using Truth.Fi as the vehicle for $BTC acquisition, probably

The Bigger Picture

Tie in Ryan Cohen’s share transfer, GameStop’s Bitcoin adoption, TMTG's fintech venture through Truth.Fi, and the rise of NYSE Texas and TXSE, and you’ve got a financial landscape on the cusp of something big.

This isn’t just noise—it’s a Golden Age for investors, a shift toward decentralized and alternative financial systems, with Texas potentially becoming a beacon for free enterprise. The pro-business vibe here could rewrite market dynamics, impacting investment strategies, and offering opportunities for growth and innovation. You are witnessing the future, now.

Stay tuned for exciting new developments on this front.

Very best,

Edwin