Hi {{ First Name }},

Welcome to an electrifying edition of our newsletter!

If you’re here, you’ve got front-row seats to the unfolding of the Golden Age thesis—a vision built on 3 unshakable pillars: GMERICA, sparked by Ryan Cohen’s GameStop turnaround; the keiretsu framework, weaving together activist investors and public corporations; and the MEGA CORP thesis, tied to President Donald Trump’s TMTG and Truth.fi (Truth Financial) Crypto venture, championing American-first companies.

Today, we’re diving into a treasure trove of insights from our latest TMC Special Livestream on X, dubbed Project Rocket Season. Buckle up—this is about to get juicy!

Disclaimer: I am not a financial advisor and I do not give out financial advice.

We’re uncovering ground-breaking news involving GameStop, Bitcoin, tariffs, and the masterful strategies of financial titans like Ryan Cohen, Michael Saylor, and Carl Icahn. These aren’t just market moves; they’re the building blocks of a new economic era. Let’s break it down and connect the dots to the Golden Age.

🎯 Here is the Livestream Replay, in case you missed it: https://x.com/edwinbarnesc/status/1918454733381222852

Insights

GameStop and Bitcoin: The Crypto Shuffle

The rumors are swirling, and the receipts are piling up—GameStop might just be holding Bitcoin! During a recent MicroStrategy ($MSTR) shareholder presentation, a sharp-eyed @Azkyrie spotted a GameStop logo in a chart titled “Bitcoin Holdings of Publicly Listed Companies.”

$MSTR leaked $GME holding $BTC during Zoom, Live Shareholder Presentation

Coincidence? We think not. This bombshell comes hot on the heels of a Bitcoin transaction hash (BH) uncovered by our Discord community (shoutout to CryptoICURN), revealing the acquisition of 25,177 BTC.

Break it down: 2+5=7, and 7/17/7, but that 17? It’s the lucky 17th letter in the alphabet tied to “Q”—a signature Ryan Cohen has been signaling towards before arriving to become chairman of GameStop in 2021.

Check out the timeline:

Date | Event |

|---|---|

December 8, 2020 | GameStop files prospectus for securities offerings, including swaps. Shelf registered with SEC. |

December 20, 2020 | Bitcoin dominance peaks and runs |

May 16, 2021 | Bitcoin hits a low—perfect dip-buying territory. |

June 9, 2021 | GameStop publishes prospectus, aligning with Bitcoin’s bottom. |

April 2025 | Bitcoin hash shows 25,177 BTC acquired—could this be GameStop’s move? |

This isn’t just speculation—it’s GMERICA in action. Ryan Cohen, greenlit by GameStop’s 10K to buy Bitcoin alongside the corporation, could be positioning GameStop as a digital economy powerhouse. If true, this is a cornerstone of the Golden Age, blending retail revival with crypto innovation.

Check the charts, SEC filings, and dates:

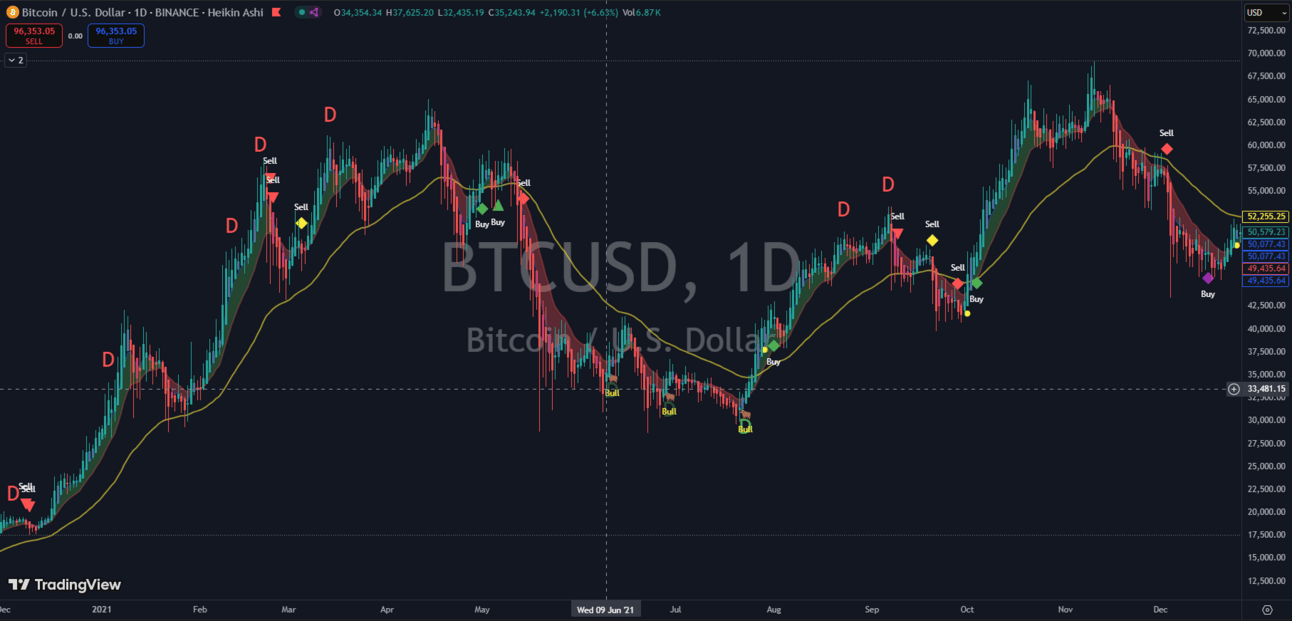

$BTC crash in May 2021 then boom cycle begins, take note of June 9, 2021

$GME releases prospectus containing units on June 9, 2021, $MSTR follows 5 days later

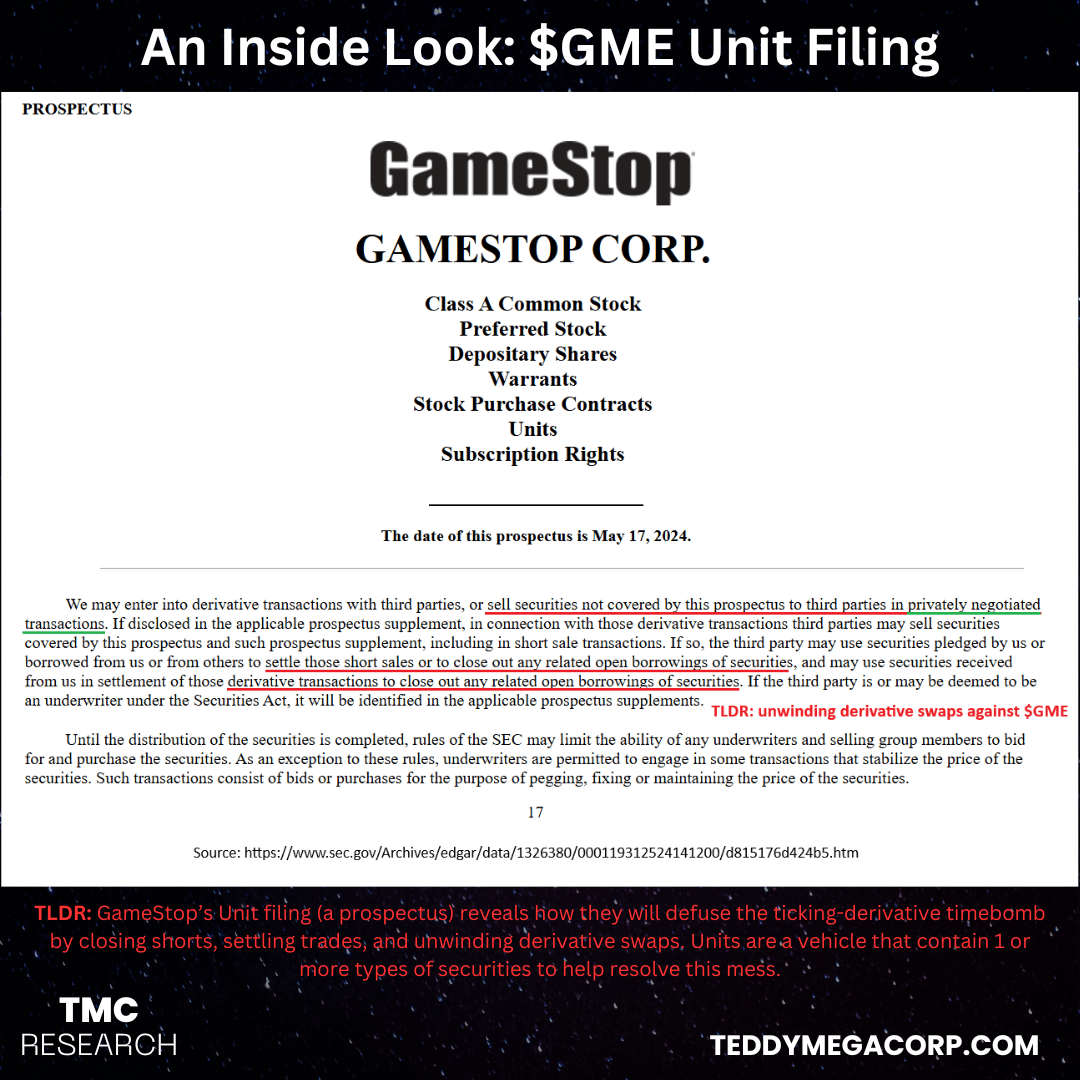

These Unit filings are essentially swaps that enable companies to take a position without having to file because they aren’t actually the ones holding the position. It is Jefferies, the middle man and investment bank, acting on behalf of $GME and $MSTR.

Financial Maneuvers: Margin Accounts and Unrestricted Bitcoin Access

Ryan Cohen’s playbook is pure genius. Per a 13D filing, he’s transferred 22 million GameStop shares (over 60% of his holdings) into a margin account at Charles Schwab. Why does this matter? Recently, Michael Saylor of Strategy dropped a hint, posting a chart showing Charles Schwab offers unrestricted Bitcoin ETF exposure.

Translation: Cohen’s got the keys to amplify his purchasing power and scoop up Bitcoin without limits. He’s on a margin account to take advantage of leverage.

Here’s the breakdown:

Player | Move | Implication |

|---|---|---|

Ryan Cohen | 22M shares to Schwab margin account | Leverage for Bitcoin or asset acquisition |

Charles Schwab | Unrestricted Bitcoin access | Flexibility to scale holdings exponentially |

Michael Saylor | Highlights Schwab’s role | Signals a coordinated keiretsu strategy |

This move screams keiretsu—interconnected players maximizing value. Cohen’s not just playing defense; he’s fueling the rocket for a moonshot, aligning with the Golden Age’s vision of financial sovereignty.

Tariffs: Pressure and Opportunity for American-First Companies

Trade policies are shaking things up, and GameStop’s feeling the heat. Using Import Yeti, we found that 99.3% of GameStop’s shipments come from Asia, mostly China. With President Trump’s tariffs in full swing (20 days into a 90-day cycle as of May 2025), costs are rising, threatening profit margins.

Check the data:

Metric | Value | Impact |

|---|---|---|

Total Sea Shipments | 3,734 | 3+7+3+4=17—lucky number alert! |

% from Asia | 99.3% | Heavy tariff exposure |

Tariff Duration | 90 days (ongoing) | Potential for empty shelves by July 2025 |

But here’s the flip side: tariffs are a double-edged sword.

They’re pushing companies to rethink supply chains, and that’s where the MEGA CORP thesis shines. Reshoring manufacturing to the U.S. could turn GameStop into a poster child for American-first resilience.

Ryan Cohen’s next move? Maybe a deal with domestic partners—or a pivot to digital assets like Bitcoin to offset trade pressures. Either way, it’s a step toward Making America Great Again.

Corporate Strategies: Swaps and SEC Filings Unveil the Plan

GameStop’s SEC filings are a goldmine. The December 8, 2020 prospectus (published June 9, 2021) greenlights the company to “offer and sell from time to time” a mix of securities—stocks, warrants, units, you name it.

Read the full “Units” decoder guide here.

The kicker? These “units” can unwind and/or bundle derivatives like swaps, letting GameStop discreetly acquire assets. The timing is uncanny: filed just before Bitcoin’s 2020 peak, published as it bottomed in 2021.

Did Cohen buy the dip? The receipts suggest yes.

Filing Date | Action | Market Context |

|---|---|---|

Dec 8, 2020 | Prospectus filed with SEC | Setting the stage |

Jun 9, 2021 | Prospectus published | Bitcoin at post-crash low |

Apr 22, 2025 | Carl Icahn uses swaps for Bosch Health | Example Swap strategy going mainstream |

Swaps are the keiretsu’s secret weapon—quiet, powerful, and perfectly legal. GameStop’s likely working with intermediaries like Jefferies to execute these moves, mirroring tactics from the activist investor playbook.

Master & Protege: The Icahn-Cohen Link

Enter Carl Icahn, the billionaire activist investor and Ryan Cohen’s rumored mentor. On April 22, 2025, Icahn revealed a 34% economic interest in Bosch Health, with 24.6% via cash-settled equity swaps.

Sound familiar? It’s the same swap strategy GameStop’s prospectus enables. And guess what? Both Icahn Enterprises and GameStop (plus $BBBY) use Jefferies as their investment bank. Swaps on swaps, building and concealing positions. No SEC filing required.

Player | Company | Swap Usage | Bank |

|---|---|---|---|

Carl Icahn | Bosch Health | 24.6% via swaps | Jefferies |

Ryan Cohen | GameStop | Prospectus allows swaps | Jefferies |

Historical Tie | Bed Bath & Beyond | Cohen’s past swap play | Jefferies |

This isn’t coincidence—it’s keiretsu in motion. Cohen’s learning from the master, using swaps to build positions (Bitcoin, anyone?) without tipping his hand. The Icahn-Cohen connection is a linchpin of the Golden Age, proving activist strategies can reshape American corporations.

Master Icahn & Protege Cohen

Market Outlook: GameStop’s Technical Edge

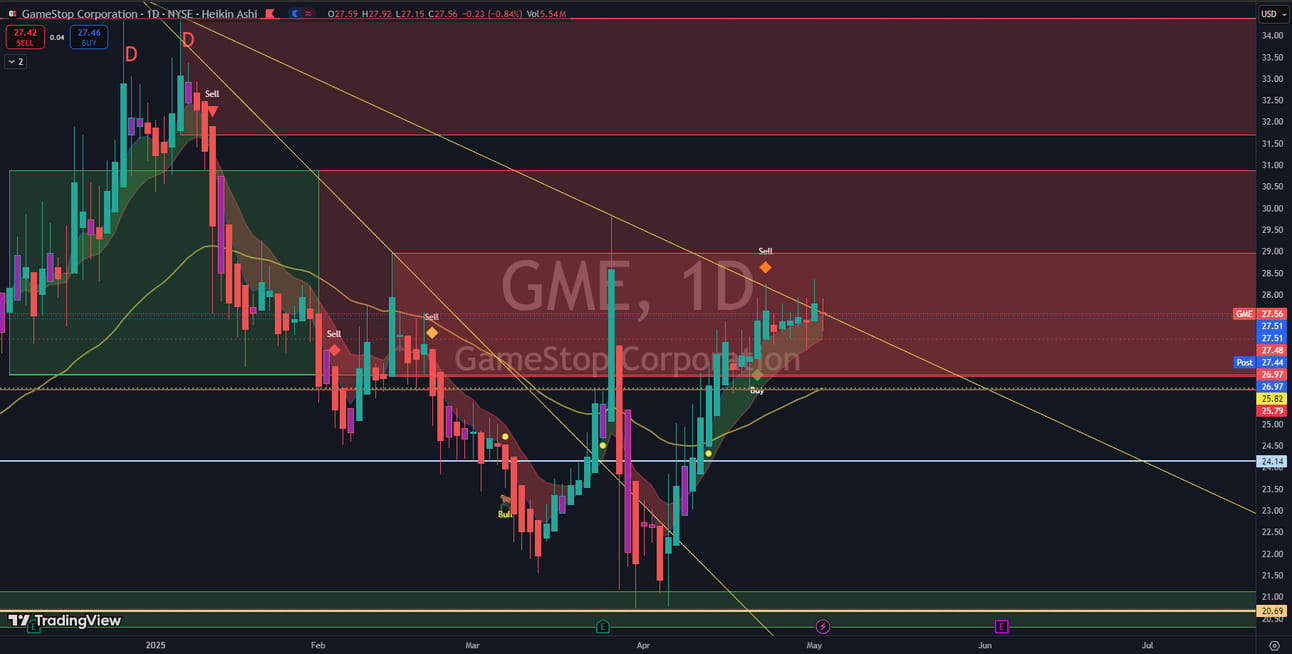

Let’s get technical. GameStop’s stock is at a crossroads, pinned at a key support level on the daily chart. It’s a rising trend with a “spinning top” candle—50/50 odds of a breakout (typically bearish, but hold this thought).

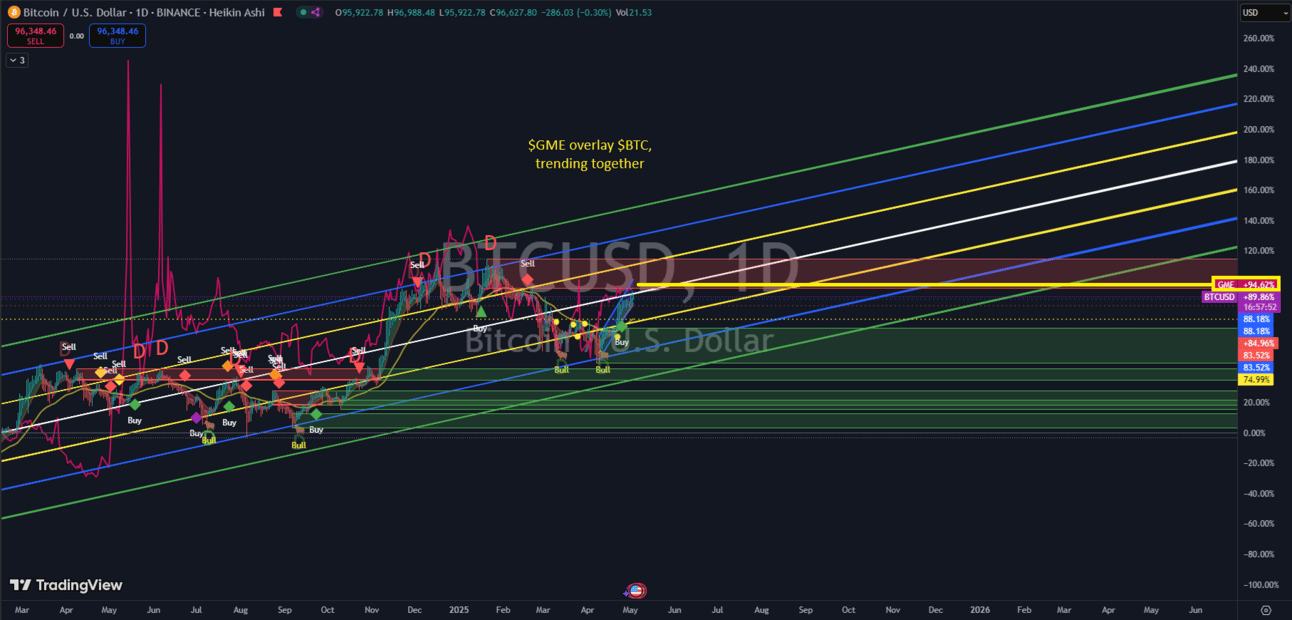

Zoom to the one-hour chart, and the algos are screaming “buy, buy, buy”—reminiscent of another stock. Overlay Bitcoin’s chart, and the correlation is undeniable: $GME is trending with $BTC.

$GME and $BTC trending together into a sell zone (typically bearish)

Timeframe | Pattern | Implication |

|---|---|---|

Daily | Spinning top candle $GME | Breakout potential |

1-Hour | Buy signals | Momentum building |

Overlay | BTC correlation | Crypto-stock synergy |

This isn’t just Crayola scribbles—it’s a rocket ready to launch. If GameStop’s Bitcoin holdings are confirmed, expect a surge that echoes 2021’s recall vibes. The Golden Age is about timing, and we’re at the precipice.

EXCLUSIVE GROK ANALYSIS

I uploaded 2 chart images to Grok for additional analysis and it took over 11mins and 47secs for the Ai to respond (here’s a video).

These are the charts:

$GME Daily timeframe - hitting the 2021 trendline, spinning top candle in upward trend (bearish), look to the left and there’s a green buy zone, meanwhile in a red sell zone

$GME Hourly timeframe - algos have pinned the stock price on the trendline, at neutral standard deviation channel (white line) with a sell signal so either pullback to $25.79 or it’s going up

So what was Grok’s response? See for yourself here.

I like the odds, so I took a position and posted it on Discord. 50/50 as we step into a $GME Super Swap Cycle. After all, it’s gonna be May 🎁

If the charts breaks, escape. Else, this is going to Uranus. Tariffs are the wild card. Will President Trump call it off? May the force be with us.

Final Thoughts: The Golden Age Takes Flight

It seems like we’re witnessing history, every day now.

GameStop’s Bitcoin play, Cohen’s financial wizardry, and the tariff-driven push for American-first resilience are no accidents—they’re the pillars of the Golden Age thesis coming to life. GMERICA’s turnaround is fueling a keiretsu network, while the MEGA CORP vision, backed by President Trump’s Truth Financial, ties it all together. This is Project Rocket Season, and the fuel is loaded.

Stay sharp, tag me if you notice anything and want insights, and grab your Project Rocket NFT ticket (promo code BQQM for 17% off—available to first 47).

This rare NFT unlocks exclusive perks as we soar toward Making America Great Again.

Visit TeddyMegaCorp.com to claim yours now. Active subbed TMC Members before the announcement will receive this ticket FREE. More details to come in a separate email on how to claim (before July 4, 2025).

Thank you for riding with us,

Edwin

p.s. One day, this NFT will be worth more than the investment cost, be tradeable, and unlock things you can’t even begin to imagine. Power to the Collectors.