Hi {{ First Name }},

Happy New Year!

I have had some time to reflect on the past year and want to start by expressing my deepest thanks and gratitude to you.

I appreciate you for being on this journey with TMC and thank you for your continued support.

Disclaimer: I am not a financial advisor and this is not financial advice.

As we step into 2025, we will be greeted by Mergers & Acquisitions across all industries. M&A activity has been held off due to the Biden Administration, but soon, it will resume.

I have no doubt in my mind that this year will be one those chapters in our lives that we will never forget, and I say this with the utmost confidence and optimism.

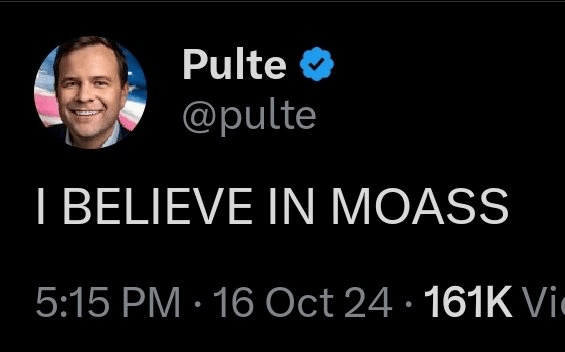

The Mother of All Short Squeezes (MOASS) is coming and nothing can stop it.

Pulte: “I believe in MOASS” (post now deleted, post-purge)

I have been asked several times: what would you invest in if you had $1,000 today?

This is a great question so I will attempt to articulate this response from a perspective as if “MOASS is tomorrow” so here is what I would do:

I would buy any stock in connection with Ryan Cohen and Bed, Bath & Beyond by “following the money”

Table of Contents

My First Stock Pick: GameStop - $GME

TLDR; $GME

GameStop stock is an idiosyncratic risk, confirmed by the National Securities Clearing Corporation (NSCC), a subsidiary of DTCC.

Therefore, $GME is a hedge against the entire stock market and wen MOASS occurs, short sellers will be annihilated and cause a chain-reaction across the global financial system because of derivative swaps.

Beyond the stock, GameStop Corporation is transforming to become a technology company, has $4.58B in cash for M&A, and is at the forefront of Web 3.0 and Metaverse with blockchain-gaming partner Immutable.

I will break down this assessment into 2 parts: first as a business, then as a stock.

GameStop as a Technology Company

Here are my reasons for investing into GameStop as a business:

$GME is led by Ryan Cohen, executive chairman of GameStop Corporation

He is a talented entrepreneur with a successful track record (Chewy.com)

Destroyed the short thesis for $GME by installing his turnaround strategy which transformed the brick-and-mortar videogame company into e-commerce (see newsletter for keiretsu on supply chain transformation)

As of December 10, 2024 in GameStop’s 10-Q filing, the company has $4.58 Billion in Cash & Cash Equivalents with virtually $0 long-term debt

GameStop is in the process of becoming a technology company in the gaming sector, a $217B global industry in 2022 with a 13% compound annual growth rate (CAGR), according to grandviewresearch.com

GameStop has an exclusive partnership with Immutable (IMX), a blockchain-based gaming company, and is building a Web 3.0 ecosystem for gamers

Immutable has more AAA+ rated Web 3.0 gaming companies, game titles, and partners in existence than any other firm (Animoca Brands is a partner), effectively pioneers in the Metaverse of gaming

The Metaverse represents a social, gaming, and interactive shopping industry within Web 3.0, for which GameStop is well-poised to become a market leader and future-proof its business

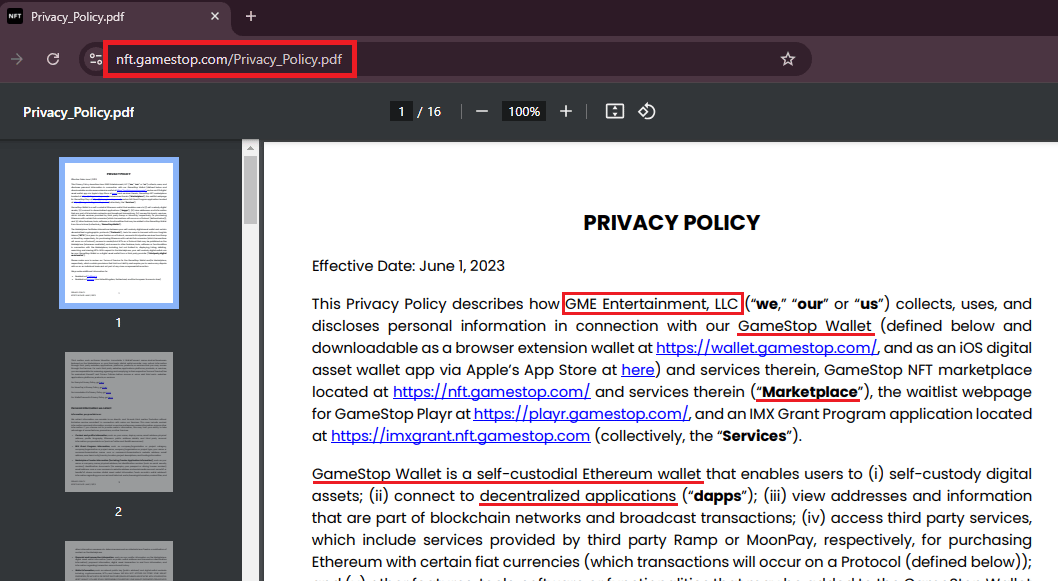

GameStop has a subsidiary company called GME Entertainment, LLC and it owns Nft.Gamestop.com - this is a hint towards Web 3.0 gaming in the Metaverse, since NFTs (non-fungible tokens) will open a floodgate for innovation and content creators

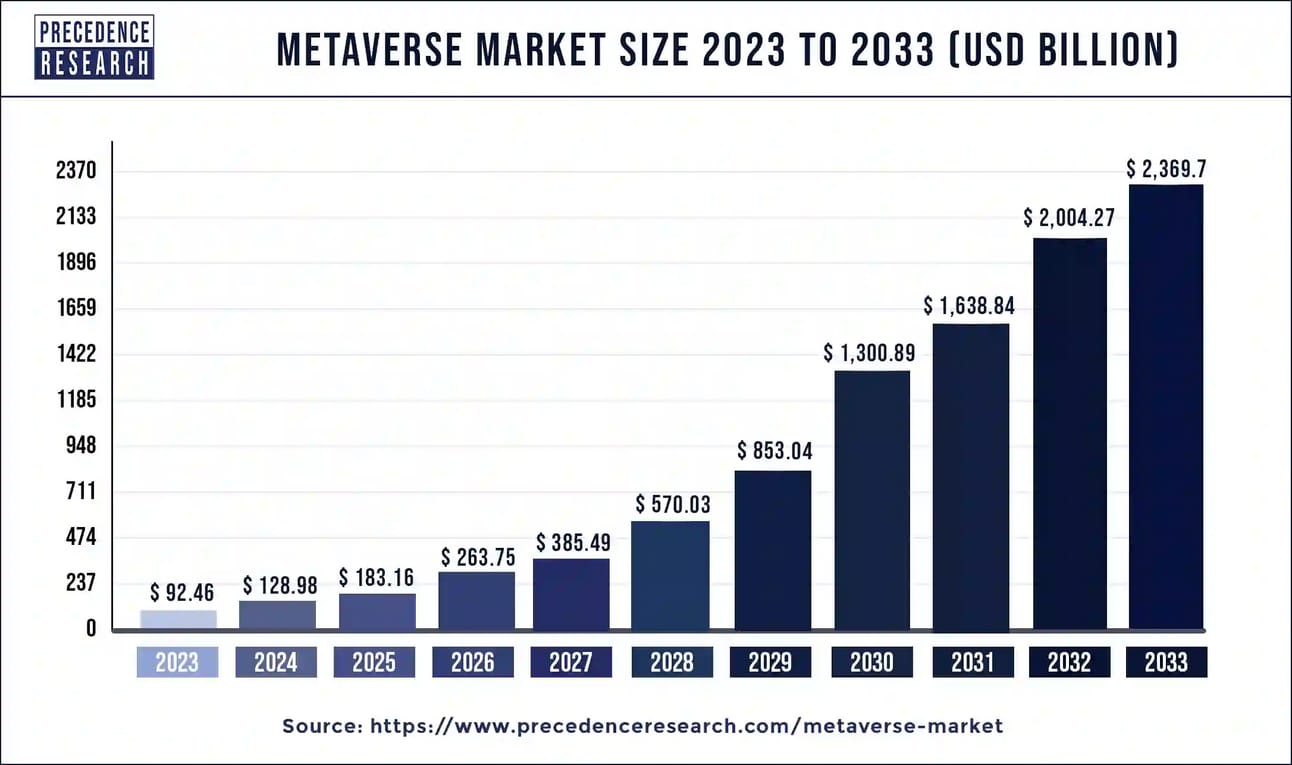

GameStop has already entered the Metaverse economy which is forecasted to become a Multi-Trillion dollar industry over the next 10 years according analysts

GameStop Corporation has an exclusive partnership with two blockchain companies: Immutable and Loopring for building and integrating blockchain services into web 3.0 for gaming and shopping in the metaverse.

GameStop agreed to work with Immutable to focus on the gaming side first. Later, they will integrate Loopring technology across the entire business that expands into the keiretsu model with tZERO, another blockchain company (brick-by-brick, for interoperability).

I will share more about Loopring in a separate newsletter since it deserves its own spotlight. For now, I only mention Loopring and Immutable in the context of blockchain integration which is vital to the development of GameStop’s purpose in the keiretsu.

In May of 2023, GameStop “paused” development on NFT and Metaverse gaming internally for the company, however, they are still in agreement with their partner Immutable who is still building and pioneering in this space.

The NFT.GameStop.com website is still active but operations are on-pause, meanwhile it shows that GME Entertainment, LLC is still the owner.

Robbie Ferguson, CEO of Immutable is leading the charge into Web 3.0 metaverse gaming and in 2024 they added hundreds of new gaming partners, gaming titles, and brokered partnerships with titans in the gaming industry.

The metaverse economy is projected to grow at a 43.9% CAGR and will accelerate year-over-year as infrastructure technology (blockchain, gaming) and companies (GameStop, Immutable) help onboard billions of gamers into this ecosystem.

According to precedenceresearch.com, by 2033, the market size for this metaverse economy is forecasted to reach $2.369 Trillion (nice).

These are strong growth indicators of a booming industry for gaming, shopping, and much more inside the metaverse economy.

If you think about it, it makes perfect sense for GameStop to focus on building the supply chain network in the keiretsu because it will enable a seamless shopping experience in omni-channel ecommerce.

During the launch of NFT.GameStop.com, there was an NFT which revealed a secret easter egg (archived post).

Inside, it led to an SEC filing and pointed a Shanghai company named Cheer Holding, Inc., which led to a video about a metaverse experience and world (watch it here).

Once you see it, it will start to make sense on what Ryan Cohen is building for ecommerce, gaming, shopping, and socializing.

Imagine being able to shop, game, and play in an immersive experience for a Web 3.0 ecosystem that delights customers for life. That’s the plan.

GameStop is an Idiosyncratic Risk

Here are my reasons for buying GameStop as a stock:

$GME holds the entire stock market together as an Idiosyncratic Risk, this is confirmed by the National Securities Clearing Corporation (NSCC), a subsidiary of the DTCC (Depository Trust & Clearing Corporation; for clearing and trade settlement)

Idiosyncratic Risk means there is a high concentration of financial positions made against the stock, and now $GME serves as a hedge against market-wide risks

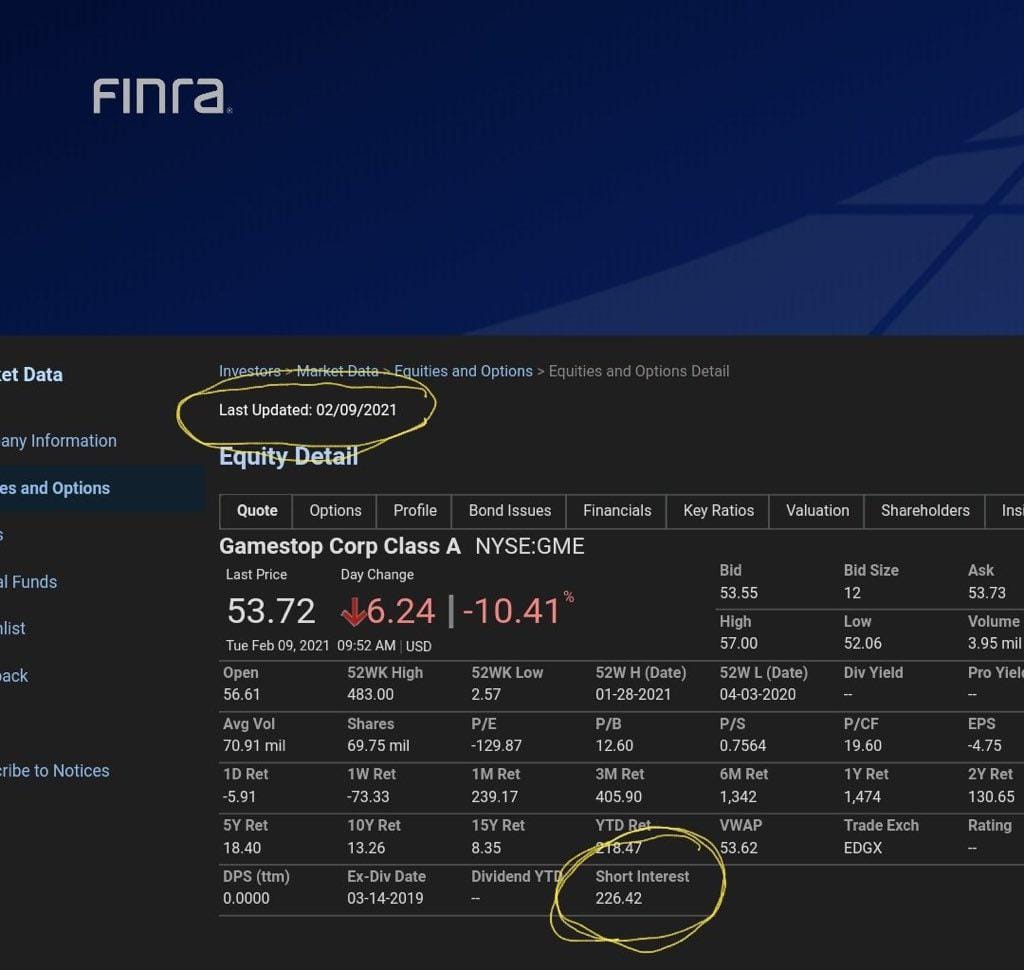

On February 9, 2021, FINRA reported $GME had a short interest of 226.42% which revealed that the number of shares sold short exceeded the number of shares in the float by more than double or 2.26 times the float. This discovery helped form the basis of the naked short thesis

The report from FINRA was released nearly 2 weeks after Robinhood and several brokers disabled the buy button and caused $GME stock price to collapse from an intraday high of $483 per share on January 28, 2021 which meant the squeeze has NOT squoze and re-affirms the short squeeze thesis leading to MOASS

The Mother of All Short Squeezes (MOASS) has been put on pause since January 28, 2021 and the naked short sellers have been kicking the can over the last 4 years in an attempt to survive another day through financial loopholes known as FTDs (failure-to-deliver shares), this occurs with bona fide market maker exemptions like Citadel Securities and Virtu Finance who can sell securities without repurchasing them for an extended period of time (endless naked shorting enabled by the DTCC)

Wen the music stops (and it will), $GME will squeeze the life out of naked short sellers and it will cause a chain-reaction across the global financial system

Several major short sellers on Wallstreet has colluded to naked short GameStop stock, which means US Treasury Bills (bonds market) forex market, crypto market, 401k, pensions, and life savings are all linked to $GME through derivative swaps

Derivative swaps enable private family offices, hedge funds, foreign investors, and others take a short position on a stock like $GME without owning the underlying asset by posting collateral to short (T-bills, crypto, forex, etc.) and has created a house of cards to suppress the true price of $GME using swaps

Supply and demand does not exist, at least not for $GME and other stocks referred to as “meme stocks” or “meme stock basket” are a group of stocks that move in the same direction as $GME price action despite a difference in market cap, total share outstanding, and available float in other public companies

Every day that naked short sellers keep their short position open on $GME, it causes them to lose hundreds of millions due to the borrow rate charged for shorting a stock (the Federal Reserve has printed millions of USD to support it)

Investors in GameStop have created a natural floor price for the stock through a movement called DRS (Direct Registration System of Shares), which is a request to the brokerage to transfer $GME shares out of DTCC and into Computershare, the transfer agent for GameStop Corporation

As of December 4, 2024, GameStop’s 10-Q filing revealed that DRS has locked up 16% of total shares outstanding, or 71 Million shares of $GME has been removed from the DTCC thus making it difficult to short the stock or use as a locate to FTD

$GME is the only stock that has an investor base that has effectively locked up shares with the transfer agent so wen MOASS occurs, there will be shares that cannot be repurchased to close a short position which has fueled speculation about an Infinity Squeeze, the likes of which have never been seen in history

The end of a 4-year cycle is coming and it will retest $GME stock at new all-time highs when catalysts such as a new company emerge (e.g. buybuyBABY of $BBBY)

Court case dockets reveal Ryan Cohen of $GME has entered into mergers and acquisitions with a consortium of investors to purchase Bed, Bath & Beyond to carve-out its subsidiary company buybuyBABY which will issue new equities and break the derivatives swaps held against $GME and launch the MOASS

The NSCC has declared $GME as an idiosyncratic risk to the entire global financial system, which means by investing into $GME, it will serve as a hedge against the MOASS.

Essentially, $GME is Noah’s Ark for investors.

From PFMI Quantitative Disclosures, additional reports confirmed what happened to $GME for the week that lead up to the short squeeze event on January 28, 2021, before the buy button was disabled:

“During the week of January 25, 2021, NSCC observed unusually high volumes and volatility in GameStop Corp. […] On January 27, 2021, NSCC made intraday margin calls to 36 clearing members totaling $6.9 billion”

This detail only confirms that brokerages were at-risk for domino bankruptcy, however, they were not forced into liquidation which would have prompted the DTCC and its subsidiaries to seize short positions and begin force closing short sellers.

Source: PFMI Quantitative Disclosures, Clarus FT

If the liquidation took place, it would have begun a massive buy back on open short positions against $GME and would have pushed the price into the thousands per share.

Thomas Peterffy, CEO of Interactive Brokers revealed on MSM news that this would have led a total collapse of the global financial system because of MOASS (see video here).

$GME = Idiosyncratic Risk and a Hedge against MOASS

Unfortunately, the buy button was disabled across multiple brokerages and the price of $GME collapsed from an intraday high of $483 on January 28, 2021.

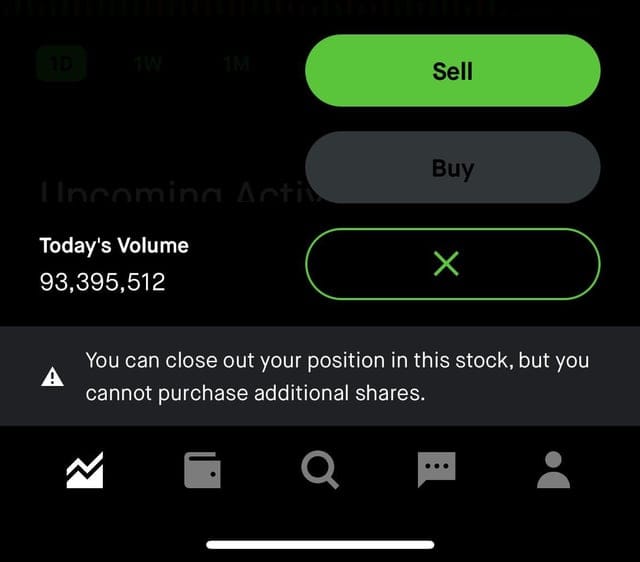

Robinhood disabled buy button on $GME and other meme stocks

By disabling the buy button, it only delayed MOASS which has been on pause for 4 years (e.g. there is a parallel with President Trump 45-47, the dash is a pause).

The pause enabled investors in $GME to learn about DRS and as of December 4, 2024, GameStop’s 10-Q filing revealed that shareholders have registered 71 Million shares or 16% of total shares outstanding.

GameStop Corporation 10-Q Filing

By registering shares, it makes it difficult for naked short sellers to FTD and ultimately, it helps to create a floor price for $GME because DRS transfers the share out of the brokerage (street name) and into your name under book-entry accounting (read official SEC on book entry vs. street name)

For every share that is registered (DRS), it removes the share from DTCC and helps to limit naked shorting of $GME, effectively putting pressure on naked short sellers to find more shares to be used as a locate but there is a limit (FTD loophole).

The goal of DRS is to lock up shares so wen MOASS takes place, it is speculated that brokerages will become unstable, according to their terms of service where brokerages may force-sell or PCO (position-close only from disabled buy button).

Meanwhile, it is believed that shares held within Computershare, the official transfer agent for GameStop, may be a safe haven to weather the MOASS because the transfer agent is unable to force-sell or PCO.

The Naked Short Thesis

On February 9, 2021, a report came out from the Financial Industry Regulatory Authority, or FINRA (a self-reporting agency) which revealed that $GME stock had a short interest of 226.42%

FINRA revealed 226% short interest on $GME (illegal and proof of crime)

This report confirmed that the short squeeze of $GME on January 28, 2021 had not squoze because there were 2.26 times more shares sold short than the available float, 2 weeks AFTER the main event.

This was a revelation and blessing because it proved there were more shares in circulation than authorized by GameStop Corporation and confirmed fake shares, synthetic shares, or phantom shares existed in the stock market.

The MOASS Thesis

The Mother of All Short Squeezes reveals that $GME leads the pack as an idiosyncratic risk due to a heavy concentration of short positions against the stock.

This is revealed by short sellers in their 13F holdings and positions from BlackRock, Charles Schwab, Vanguard, Fidelity, Jane Street, Citadel, UBS, and many others (lookup 13F holdings on fintel.io)

These Wallstreet short sellers do not use their money, but instead use money from 401k, pension funds, and other sources to short $GME which means everyone is at-risk during MOASS.

A little story about 401k, Financial Advisors, & Short Sellers:

Have you ever been offered a 401k at your workplace?

Chances are you had a representative like Fidelity come in and offer to setup a 40-60 split and allocation towards 40% bonds and 60% stock to plan your retirement.

The thing is, Fidelity hopes to “make money” using your money because they get paid percentages as your financial advisor, so what happens next is they loan your 401k to some degenerate gambler on Wallstreet like Melvin Capital who then yolo bets your retirement to short a stock like $GME hoping to make a couple bucks too, until a bunch of people start buying $GME, refuse to sell, and suddenly Wallstreet is caught in a short squeeze.

And that’s exactly what happened in January 2021. Fidelity had indirectly shorted $GME because they loaned your 401k to some degenerate gambler on Wallstreet who used your money to gamble and lost it all.

Next, they tell you the stock market crashes every now and then so you should just deal with it because in 20-30 years your portfolio will break-even when the market recovers.

In reality, 401k is a ponzi scheme because they don’t let you access it and a lot of these financial advisors turned out to be degenerate gamblers which is what shorting $GME exposed to the world. If you want proof check their 13F filings, receipts don’t lie.

Now here’s a chart that reveals those short sellers and their 13F filings during March 2021:

Data gathered from 13F holdings between 12/31/2020 - 3/31/2021

These positions have changed drastically, but during that time it painted a very clear picture of how grim the situation was for these short sellers that held lots of put contracts (short position) against $GME and very few, if any GameStop shares (naked short positions are not disclosed).

Meanwhile, mainstream media outlets ran hit pieces and bought ads that attempted to get the public to sell $GME shares

CNBC bought ads to advertise short sellers closed short positions

The fake news and shills attempted to plant narratives that the shorts had closed their short position, which were outright lies. If they had closed their positions, they would not have had those short positions reported in March 2021 inside 13F filings (receipts matter).

Best of all, it wasn’t just $GME that was heavily naked shorted but other stocks in this meme basket such as $AMC, $KOSS, $BB, and so many more.

To add fuel to fire, the entire stock market (really a casino) is now held together by another instrument called derivatives swaps and were exposed when Archegos Capital imploded in March 2021 due to $GME squeeze in January 2021 (read about it here).

If any one of these stocks in the meme basket were to squeeze, it would cause the next stock to squeeze and cause a chain-reaction leading to cascading margin calls and liquidations across the stock market.

Suffice to say, the squeeze still has not squoze and the shorts are trapped in $GME pending MOASS.

The Infinity Squeeze Thesis

There is speculative belief of an Infinity Squeeze for 3 key reasons:

The Naked Short thesis was confirmed by the short interest from FINRA, 2 weeks after the pause of January 28, 2021 which meant the squeeze has not squoze

The MOASS thesis also known as the everything squeeze reveals that $GME and other highly shorted meme stocks in the basket will trigger a chain-reaction causing the markets to violently squeeze leading to cascading margin calls and liquidation that force buy backs to close short positions thus pushing prices higher

The Infinity Pool thesis suggests that if the naked short thesis is true and the MOASS thesis is true, then there will come a time when shares held in DRS by investors will be able to play a game called “name your price” because shares held in DRS will need to be purchased to close out short positions during liquidation but if nobody sells the price will be JUST UP (read here).

Read about my thoughts on DRS here and find out how to DRS at whydrs.org

Bottomline: $GME

GameStop is developing on multiple fronts. This includes making headway into Web 3.0 shopping and gaming in the metaverse with Immutable.

The company is transforming its supply chain network to serve the keiretsu and will join a collective of other titans of industry to usher in a Golden Age that few outside of the GMERICA community understand.

We are very early and are blessed to receive this once-in-a-life opportunity. There will never be another idiosyncratic stock or MOASS like this.

I’ll admit, this is a truncated version of years upon years of research, however, I hope it will serve as a starting point to help you see there is no other stock like $GME for MOASS.

In the next stock pick, I will share with you some alternatives because of the prospectus filings containing units which are also a hedge and counter to the meme stock swap basket.

Thanks for reading!

Very best,

Edwin

p.s. Do you believe in the MOASS, why or why not?